How Much Does a Bookkeeper Cost?

Content

Using outside firms to handle your bookkeeping is similar to hiring an in-house bookkeeper to handle basic bookkeeping responsibilities without the added overhead cost of carrying employees on your payroll. This is highly beneficial to companies entering a growth stage without having to provide additional office space or pay salary benefits. Before using a company’s services, it’s crucial to discuss your unique demands and requirements with them and gain a comprehensive grasp of their pricing policy. Did you know the average small business spends over 100 hours per year on administrative tasks like bookkeeping?

Many businesses hire a virtual bookkeeping assistant to remotely manage all their bookkeeping tasks. This allows for efficient record-keeping and timely financial reporting at all times. Now that you understand bookkeeping services and what goes into the cost of bookkeeping, let’s explore bookkeeping packages. Before selecting a bookkeeper, business owners should first understand what services they need and find a package that fits the bill.

Career Path for Bookkeeper

This bookkeeper salary guide explores ways for emerging and established bookkeepers to improve their job prospects and earning power. Before I got into bookkeeping, I had experience in banking, accounts payable, payroll (in the US, not NZ), and sales. I sold Tupperware, sang in bands and I was a wife and a parent (negotiation skills anyone??).

The average price of outsourcing your bookkeeping needs ranges depending on the number of transactions and complexity of services required. A key benefit of Outsourcing is it gives you the ability to customize the services you receive to your bookkeeping needs. Hourly rates for internal, part-time average around $21-23/hour depending on job description and location.[1] They typically are performing basic bookkeeping duties and will need to be supervised and managed.

What it Costs to Hire an In-House Bookkeeper

A full-time bookkeeper is typically expected to handle everyday accounts, keep account books in order, and take care of tasks that are small and large (invoicing, timesheets, generating reports, etc). If your company has a lot of employees, records a lot of transactions daily, or has complex financial systems, https://www.bookstime.com/pricing a full-time bookkeeper is a necessity rather than an option. The average salary for a bookkeeper in the United States in 2018 is around $14-$17 per hour (per Indeed) which is about $2,400 to $3,000 per month. The average annual salary for bookkeepers is between $37,000 to $47,000 (per Salary.com).

How do you charge for accounting services?

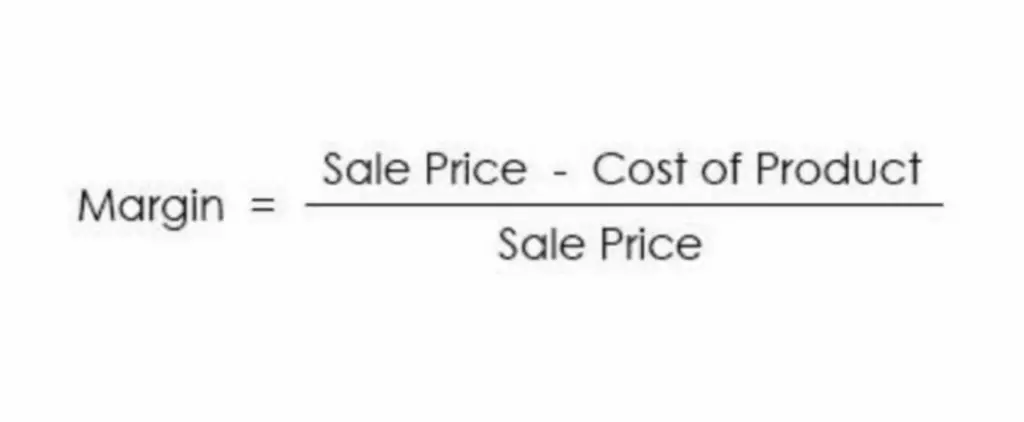

Cost-plus pricing

A basic strategy for pricing your accounting services is cost-plus pricing. In this strategy, you take what it costs to offer your services and add a percentage to that amount to determine how much you should charge clients in order to make a profit.

Keep in mind that these are averages, for the entire state – in large, diverse states, local salaries might vary a lot from the statewide average. For example, salaries in San Francisco or Los Angeles are likely to be significantly higher than in Redding or Bakersfield, even though they’re all in California. Otherwise, you may wind up missing out on profits or scaring off clients with high rates. Typically, you’ll want to charge your more frequent clients at a lower rate because you’re seeing them more often and reviewing their books on a regular basis. For one-time clients, you may decide to charge more since you know they may not return and have last-minute requests and needs.

HOW TO START A BOOKKEEPING BUSINESS

On average, a business can expect to pay anywhere from $250 to $2,500 a month to outsource their bookkeeping needs, depending on the number of transactions and accounts, and the intricacy of the transactions. Full-charge bookkeeping is a type of bookkeeping service where the bookkeeper is responsible for overseeing all of a business’s bookkeeping requirements. From accounts payable and receivable to payroll, bank reconciliations, financial statements, and more. This professional is expected to manage all facets of the company’s bookkeeping affairs. If either part-time or in-house bookkeeping is not the ideal solution, switching to outsourced bookkeeping or accounting could be your best option.

Because this type of service requires a lot of industry-specific knowledge, you’ll be able to charge a higher rate than on typical bookkeeping engagements. Small clients often have simple bookkeeping needs and small revenue, so you may want to charge them less. For instance, you may charge an hourly rate of $40 to a large https://www.bookstime.com/ client that earns up to $2 million in revenue and around $30 for a very small client with an annual revenue of $300,000. The average hourly rate for bookkeepers in the U.S. is $20 per hour, according to

Salary.com. The range swings from $18 to $25 per hour, and there’s a lot of room for growth beyond the $25/hour figure.

Where Should I Work as a Bookkeeper?

Partnering with Patriot earned this accountant a 50% cost savings from his previous provider, decreased his time running payroll, and more! So, don’t be afraid to boast about your experience while marketing your accounting firm. And, use it as a competitive advantage when it comes to pricing your offerings. Smaller clients generate less revenue than medium or large clients. Therefore, you generally want to charge a small client less because they have fewer needs. If you have a client with one bank account and 400 transactions, that’s going to take significantly less time than if you have a client who has 4 bank accounts each with 100 transactions.

- Bookkeepers still play important roles on accounting teams, especially in the small business world.

- By outsourcing your accounting needs to well-trained virtual assistants, you can rest assured of a robust, scalable, and streamlined accounts process while focusing on your larger business goals.

- As an employee, there are more hoops for an employer to jump through to terminate employment.

- Better to start as you mean to continue with the rate, whilst not charging for slow or learning time.

One thing you need to be aware of is how many bank accounts your client has. Each bank account will take you significantly more time because you will have to look up the statements individually and reconcile them. This way of charging has changed quite a bit now that we have QuickBooks Online.

Outside expenses are covered by you

Such nuances can make the division of labor and trust a real strain on the employer and their company. They are in charge of maintaining your financial books by keeping track of expenditures and revenue. This is performed by entering data into an accounting software like QuickBooks. Before looking to hire a full-time employee to maintain your books, you should first figure out what kind of responsibilities you need to have handled. A full-time accountant is an upgrade over a basic bookkeeper, as they require less oversight and provide greater expertise across the board.

- Depending on your geographic location, this amount will be more or less than the average national rate of $34.67 per hour.

- Unsurprisingly, the BLS identifies accounting, tax prep, bookkeeping, and payroll services as the industry that employs the most bookkeepers.

- Once you evaluate the average rate of pay for your geographic location, your level of education, and any certifications, you’ll have a better idea of what to expect in terms of an hourly rate.

- Monthly and quarterly clients often require less work than those you see once a year because you review their books more often.

Some industry experts believe that not enough bookkeepers are emerging to fill available job openings, indicating opportunities for professionals with the right skills. Employers in areas with higher living costs also tend to pay a premium. However, keep in mind that those higher living costs may cancel out the financial benefits of increased bookkeeping salaries. Also, note that the degree-related salaries cover all accounting professionals who hold that degree. Instead of graduate degrees, bookkeepers can earn professional certifications that indicate greater ability. These include the certified bookkeeper (CB) designation offered by the American Institute of Professional Bookkeepers.

Hourly Bookkeeping Rates Frequently Asked Questions

It’s reasonable for a new bookkeeper to charge around $40 an hour, but you’ll need to do some research in your area to make sure that is a good starting point. From there, you can raise your rates as you gain more experience, and many top out around $80 or more an hour. Danielle Bauter is a writer for the Accounting division of Fit Small Business. She has owned Check Yourself, a bookkeeping and payroll service that specializes in small business, for over twenty years. She holds a Bachelor’s degree from UCLA and has served on the Board of the National Association of Women Business Owners. She also regularly writes about travel, food, and books for various lifestyle publications.

- For example, do you already have a QuickBooks Online account, or do you need to purchase one in addition to bookkeeping services?

- The value that you get as a contractor usually goes beyond the money as well.

- Otherwise, you may wind up missing out on profits or scaring off clients with high rates.

- On the other hand, getting the sale can sometimes involve hours of networking and meetings, and marketing and branding work, which can also be expensive.