Finance

Eligibility

Whether a student can get a Tuition Fee Loan depends on their:

- university or college

- course

- nationality or residency status

University, college and course

The course must be at an eligible university or college in the UK and one of the following:

- First degree, eg BA, BSc or BEd

- Foundation Degree

- Certificate of Higher Education

- Diploma of Higher Education (DipHE)

- Higher National Certificate (HNC)

- Higher National Diploma (HND)

- Postgraduate Certificate of Education (PGCE)

- Initial Teacher Training (ITT)

- Integrated Master’s

They could also be eligible for funding if they’re studying a Level 4 or 5 qualification with HTQ approval e.g., Certificate, Diploma or NVQ. To find out if their course is HTQ approved and qualifies for undergraduate student finance they should speak to their university or college.

If they’re studying a Level 4 or 5 qualification that is not HTQ approved or does not qualify for undergraduate student finance, they could still be eligible for an Advanced Learner Loan.

Higher and degree apprenticeships

They cannot get funding from Student Finance England if they’re studying a course as part of a higher or degree apprenticeship.

Previous study

Students can usually only get student finance for their first undergraduate higher education qualification, even if their previous course was self-funded.

The number of years for which they are eligible for funding is calculated as:

Length of current course + one year – years of previous study

If they haven’t got enough years of funding left to cover their course, they’ll have to cover some of the cost themselves.

However, they may still get some funding if, for example:

- they change course

- they leave a course but start another

- they’re ‘topping up’ a higher-education qualification, for example they have finished an HNC, HND or Foundation Degree and now want to do an Honours degree.

They might be able to get an extra year of tuition fee support if they need to repeat a year due to compelling personal reasons, such as bereavement or illness.

They would need to provide evidence of this. Depending on their circumstances, this could include:

- medical evidence from their GP

- evidence from social services

- evidence from their university or college.

Full financial support is available if the student already has a degree but they’re starting:

- an Initial Teacher Training course, not exceeding two years and they don’t hold qualified teacher status, or

- a Nursing, Midwifery or Allied Health Professional course in England on or after 1 August 2017.

Nationality or residency status

When they’re eligible for tuition fee and living cost support

Student Finance Eligibility Status:

- British Passport

- ILR( Indefinite Leave to Remain) Holder

- EU Member (Settled and Pre- Settled)

- Refugee Status

They can apply for full support if all the following apply:

- they’re a UK national or Irish citizen or have ‘settled status’ (no restrictions on how long they can stay)

- they normally live in England

- they’ve been living legally in the UK, the Channel Islands or the Isle of Man for 3 continuous years before the first day of their course, apart from temporary absences such as going on holiday

They may be eligible for full support if they’re a UK national (or family member of a UK national) who both:

- was living in the EU, Switzerland, Norway, Iceland or Liechtenstein on 31 December 2021, or returned to the UK by 31 December 2020 after living in the EU, Switzerland, Norway, Iceland or Liechtenstein

- has been living in the UK, the EU, Gibraltar, Switzerland, Norway, Iceland or Liechtenstein for the past 3 years

They may also be eligible if their residency status is one of the following:

- refugee (including family members)

- humanitarian protection (including family members)

- migrant worker or frontier worker from the EU, Switzerland, Norway, Iceland or Liechtenstein (including family members) with settled or pre-settled status

- child of a Swiss national and they and their parent have settled or pre-settled status under the EU Settlement Scheme

- child of a Turkish worker who has permission to stay in the UK – they and their Turkish worker parent must have been living in the UK by 31 December 2020

- a stateless person (including family members)

- an unaccompanied child granted ‘Section 67 leave’ under the Dubs Amendment

- a child who is under the protection of someone granted ‘Section 67 leave’, who is also allowed to stay in the UK for the same period of time as the person responsible for them (known as ‘leave in line’)

- granted ‘Calais leave’ to remain a child of someone granted ‘Calais leave’ to remain, who is also allowed to stay in the UK for the same period of time as their parent (known as ‘leave in line’)

- they, their parent or step-parent have been granted indefinite leave to enter or remain in the UK as a victim of domestic violence or abuse

- they, their parent or step-parent have been granted indefinite leave to remain as a person who has been a bereaved partner

- they or their family member have been granted leave under the Afghan Relocations and Assistance Policy (ARAP)

- they or their family member have been granted leave to enter or remain in the UK under the Ukraine Family Scheme, the Homes for Ukraine Sponsorship Scheme or the Ukraine Extension Scheme

They could also be eligible if they’re not a UK national but they have a form of leave to remain issued by the Home Office and are:

- under 18 and have lived in the UK for at least 7 years

- 18 or over and have lived in the UK for at least 20 years (or at least half of their life)

They must have been living in the UK, the Channel Islands or the Isle of Man for 3 continuous years before the first day of their course.

When they’re eligible for help with their tuition fees only

They may be able to apply for tuition fee funding if they’re:

- a UK national or a family member of a UK national who has resident status in Gibraltar and has been living in the UK, Gibraltar, Switzerland, Norway, Iceland or Liechtenstein for the past 3 years before the first day of the first academic year of their course

- a person with settled status in the UK and they have been living in the UK, Channel Islands, the Isle of Man or the British overseas territories for the past 3 years before the first day of the first academic year of their course, with at least part of that time spent in the British Overseas Territories

- a person with settled status in the UK and they have been living in the UK, Channel Islands, the Isle of Man or Ireland for the past 3 years before the first day of the first academic year of their course (with part of that time spent in Ireland)

- a person of Chagossian descent and have British citizenship

- a family member of a person with settled status in the UK and they have been living in the UK, Channel Islands or the Isle of Man for the past 3 years before the first day of the first academic year of their course

- an Irish citizen and they have been living in Switzerland, Norway, Iceland or Liechtenstein before 31 December 2020 and in the UK, Gibraltar, Switzerland, Norway, Iceland or Liechtenstein for the past 3 years before the first day of the first academic year of their course

- a worker (or family member of a worker) from Switzerland, Norway, Iceland or Liechtenstein, a child of a Swiss national or the child of a Turkish worker and they do not qualify for full support as they have lived in the overseas territories (other than Gibraltar) at some stage in the 3 years before the start of their course

The first day of the first academic year of their course is:

- 1 September, if their course starts between 1 August and 31 December

- 1 January, if their course starts between 1 January and 31 March

- 1 April, if their course starts between 1 April and 30 June

- 1 July, if their course starts between 1 July and 31 July

Distance learning

Students who are overseas may be eligible if they’re:

- a member of the UK Armed Forces serving overseas

- a spouse or civil partner living with a member of the UK Armed Forces serving overseas

- a child, step-child or adoptive child living with a member of the UK Armed Forces serving overseas

- a dependant parent living with either a child who is a member of the UK Armed Forces serving overseas or the child’s spouse or civil partner who is a member of the UK Armed Forces serving overseas.

This applies to students starting an eligible distance learning course on or after 1 August 2016.

From 1 August 2018 students studying a distance learning course will also be able to get a Tuition Fee Loan if they’re:

- a member of the UK Armed Forces who usually lives in England but are serving in Wales, Scotland or Northern Ireland

- a relative living with a member of the UK Armed Forces serving in Wales, Scotland or Northern Ireland.

Path consultants

Independent school professionals

Unique insight

School Search

How it’s paid

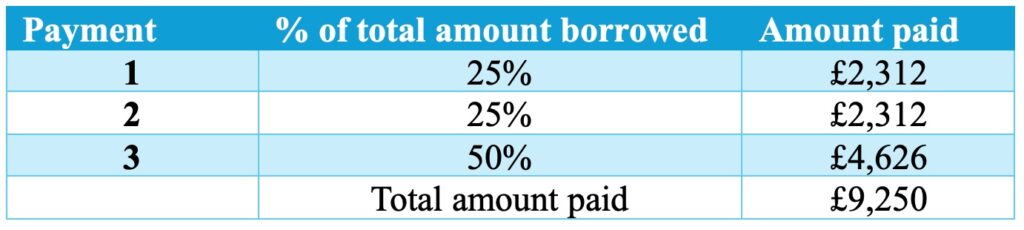

The Tuition Fee Loan is paid directly to the university or college in 3 instalments during the academic year.

Students need to register at their university or college before we can make their first payment.

The first two payments are each 25% of the total amount borrowed. The final payment is the remaining 50% of the total amount borrowed.

Example

A student borrows a Tuition Fee Loan of £9,250, this will be paid to the college or university in the following payments:

STUDENT GET MAINTENANCE AND LOAN UP TO £22,000 EVERY YEAR! (DEPENDING ON FAMILY CIRCUMSTANCES)

Maintenance and Loan Repayment

Students are charged interest from the day we make their first student finance payment until their loan is repaid in full or cancelled.

The interest rate is based on the UK Retail Price Index (RPI) and will vary depending on their circumstances.

They have to repay any loan they borrow but usually not until the April after they finish or leave their course.

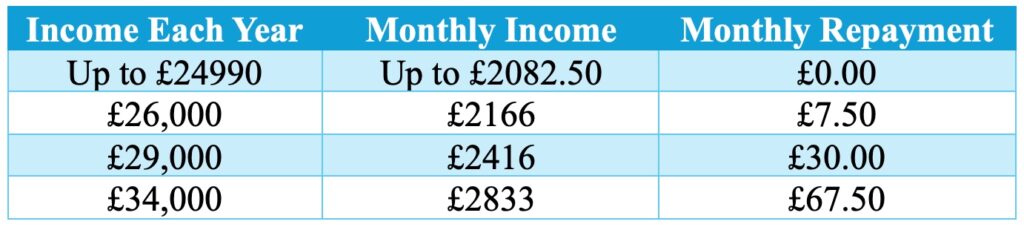

How much they repay each month depends on their income, not how much they borrowed.

They’ll repay 9% of their income over the repayment threshold, these are different depending on which repayment plan the student is on.

If their income drops below the threshold, all repayments will stop automatically.

Find out more about repayment at www.gov.uk/repaying-your-student-loan